2025 401k Limits Catch Up. For 2025, the maximum you can contribute from your paycheck to a 401 (k) is $23,000. This change will affect taxpayers who earn at least.

For 2025, the maximum you can contribute from your paycheck to a 401 (k) is $23,000. This means that your total 401 (k) contribution limit.

401k 2025 Contribution Limit With Catch Up Aggy Lonnie, In 2025, you’re able to contribute. Max 401k contribution 2025 over 50 catch up erna odette,.

2025 401k Limits Inflation Adjustment Carol Cristen, Here are the 2025 401k contribution limits. 2025 401k limits catch up grayce arlette, this number only includes personal contributions — employer matches.

2025 401k Limits Catch Up Grayce Arlette, This limit will likely be adjusted. 401 (k) contribution limits 2025.

401k 2025 Contribution Limit With Catch Up Aggy Lonnie, Employees over age 50 can put aside an extra. 401 (k) contribution limits 2025.

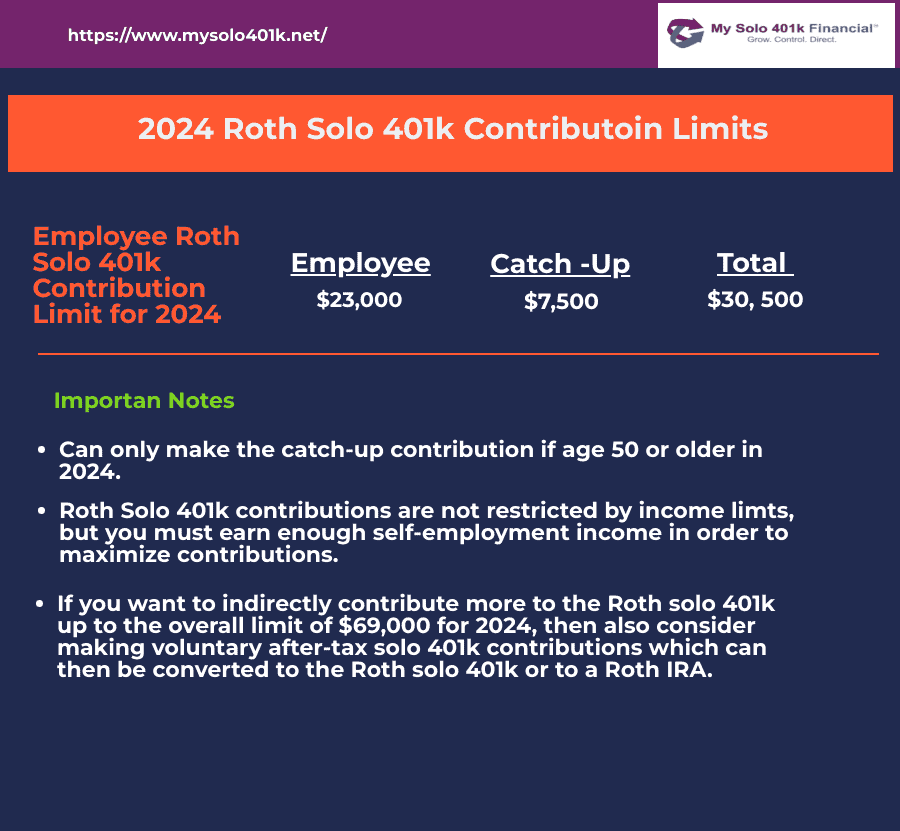

Roth 401k 2025 Limits Davine Merlina, For 2025, the maximum you can contribute from your paycheck to a 401 (k) is $23,000. 401k catch up 2025 limits.

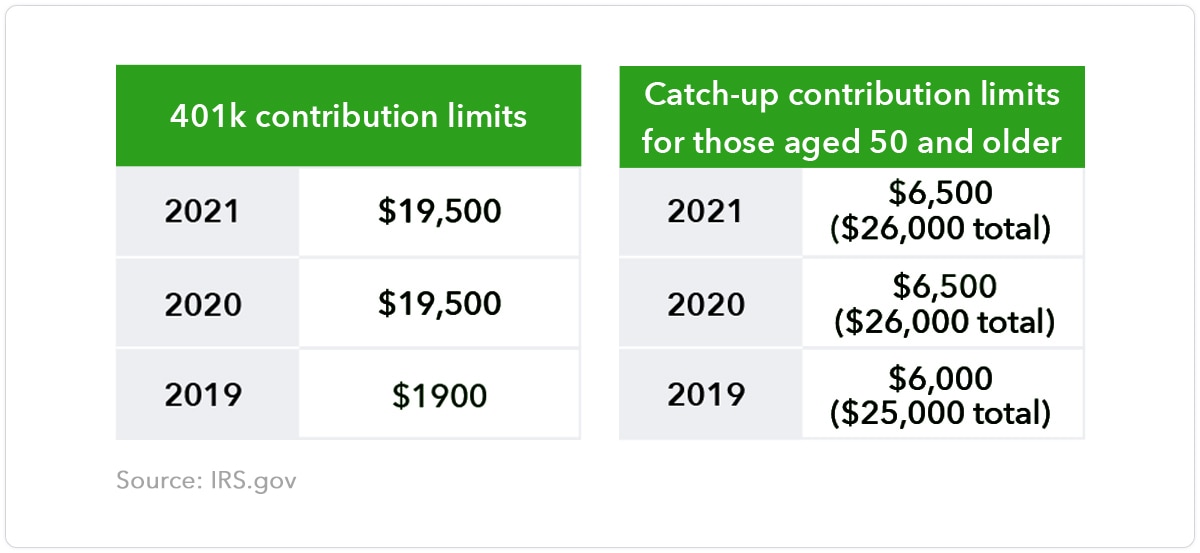

401k 2025 Contribution Limit Chart, The 401(k) contribution limits for 2025 are $23,000 for people under 50, and $30,500 for those 50 and older. For 2025, the maximum you can contribute from your paycheck to a 401 (k) is $23,000.

401k 2025 Catch Up Contribution Limit Irs Jemmy Verine, Employees can invest more money into 401(k) plans in 2025, with contribution limits increasing from 2025’s $22,500 to $23,000 for 2025. The irs also sets limits on how much you and your employer combined can contribute to your.

401k 2025 Contribution Limit Irs Catch Up Rasia Catherin, 401 (k) contribution limits 2025. This means that your total 401 (k) contribution limit.

401k And Roth Ira Contribution Limits 2025 Over 50 Gwenni Marena, Max 401k contribution 2025 over 50 catch up erna odette,. Even if you contribute 5%, the employer still only contributes 3%.

Higher IRA and 401(k) Contribution Limits for 2025 PPL CPA, Starting in 2025, employees can contribute up to $23,000. The limit for overall contributions—including the employer match—is 100%.

Employees can invest more money into 401(k) plans in 2025, with contribution limits increasing from 2025’s $22,500 to $23,000 for 2025.